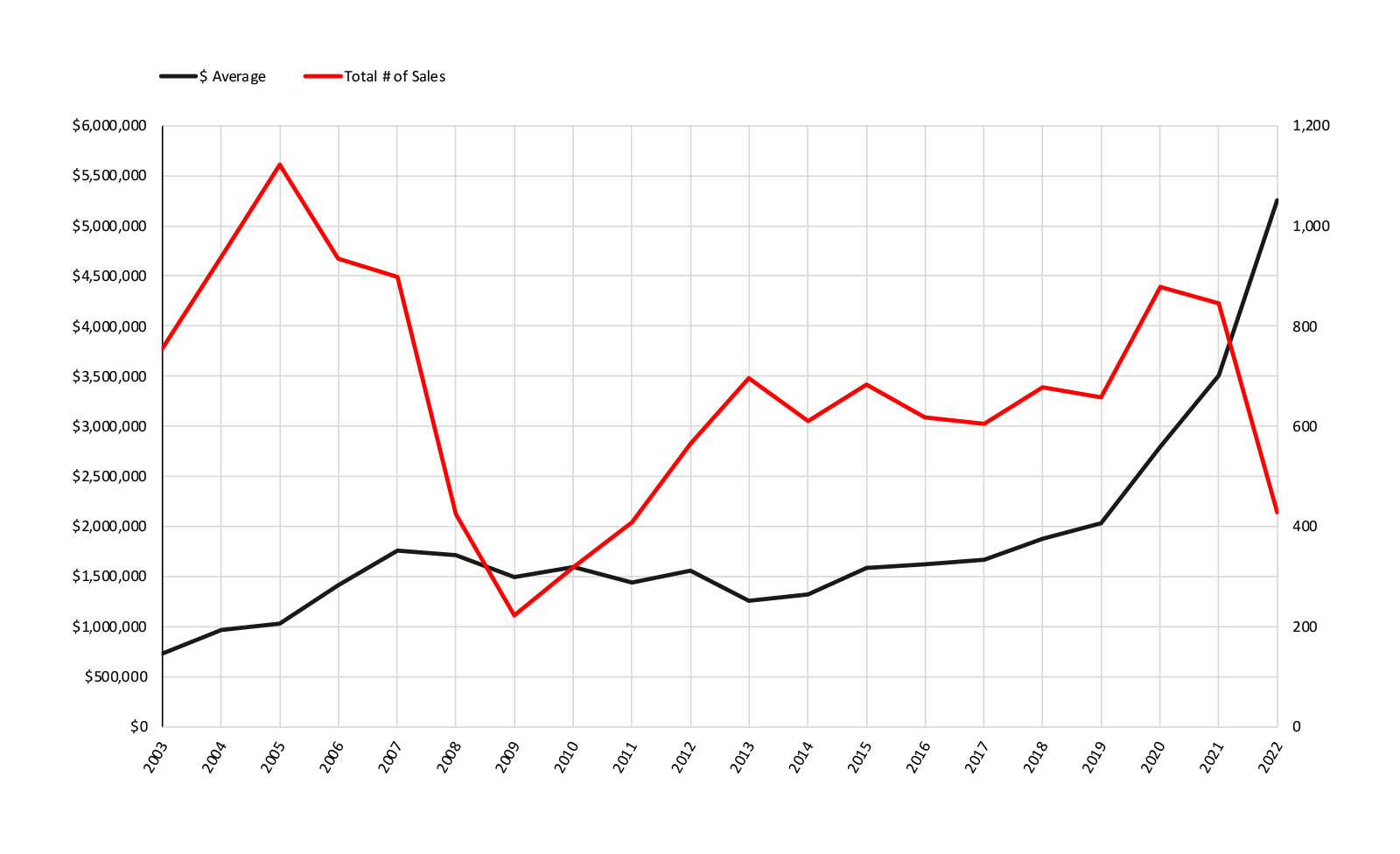

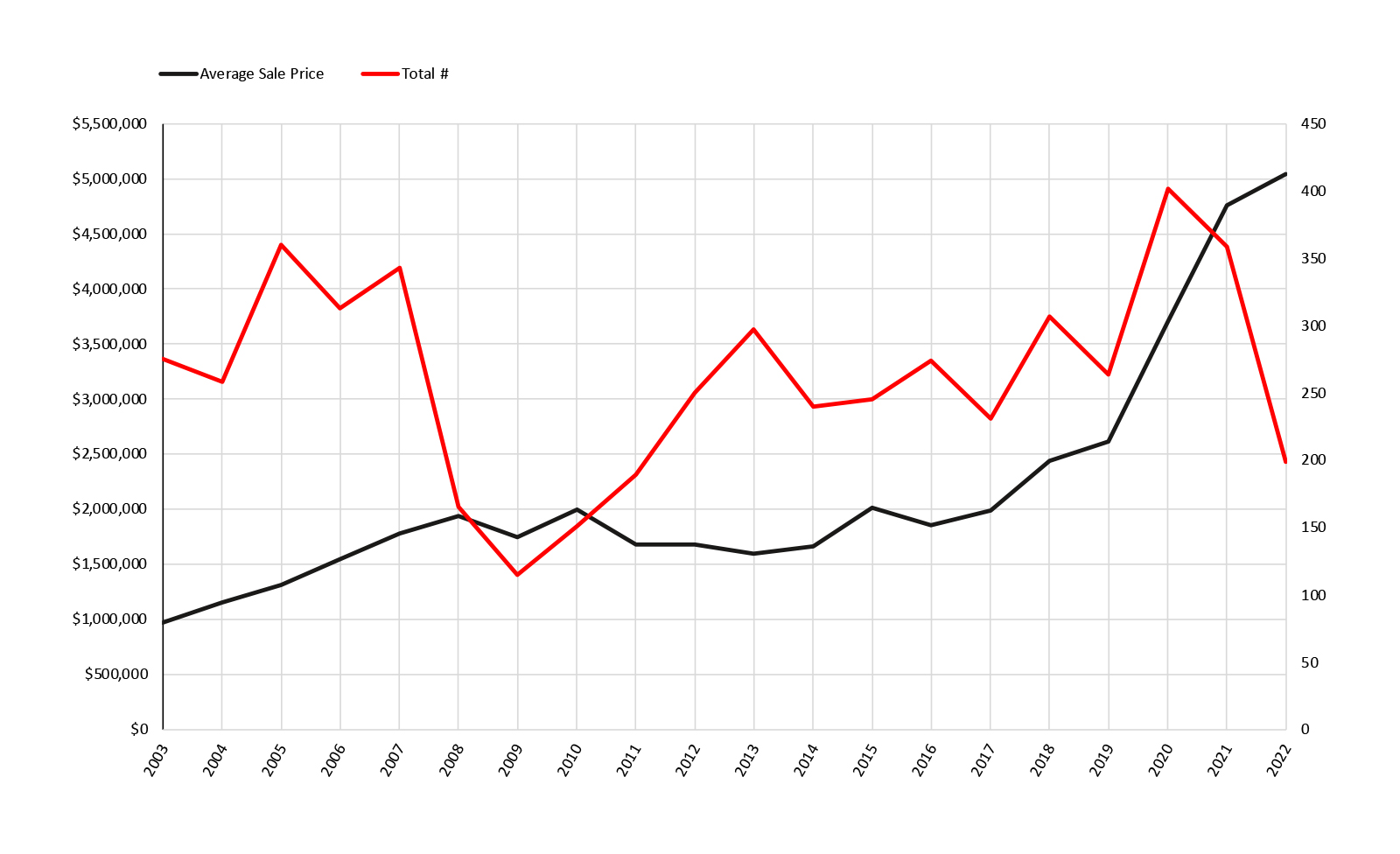

For the first time in Jackson Hole real estate history the single-family home average sale price tops $5 million. Not only is this record-breaking, but it only took three years to double – 2019 the average sale price reached $2.6 million. If that shocks you, consider the average list price of a single-family home at year’s-end was $7.6 million. NOTE: There are currently only eight homes listed for under $2 million versus 24 homes listed for over $7 million.

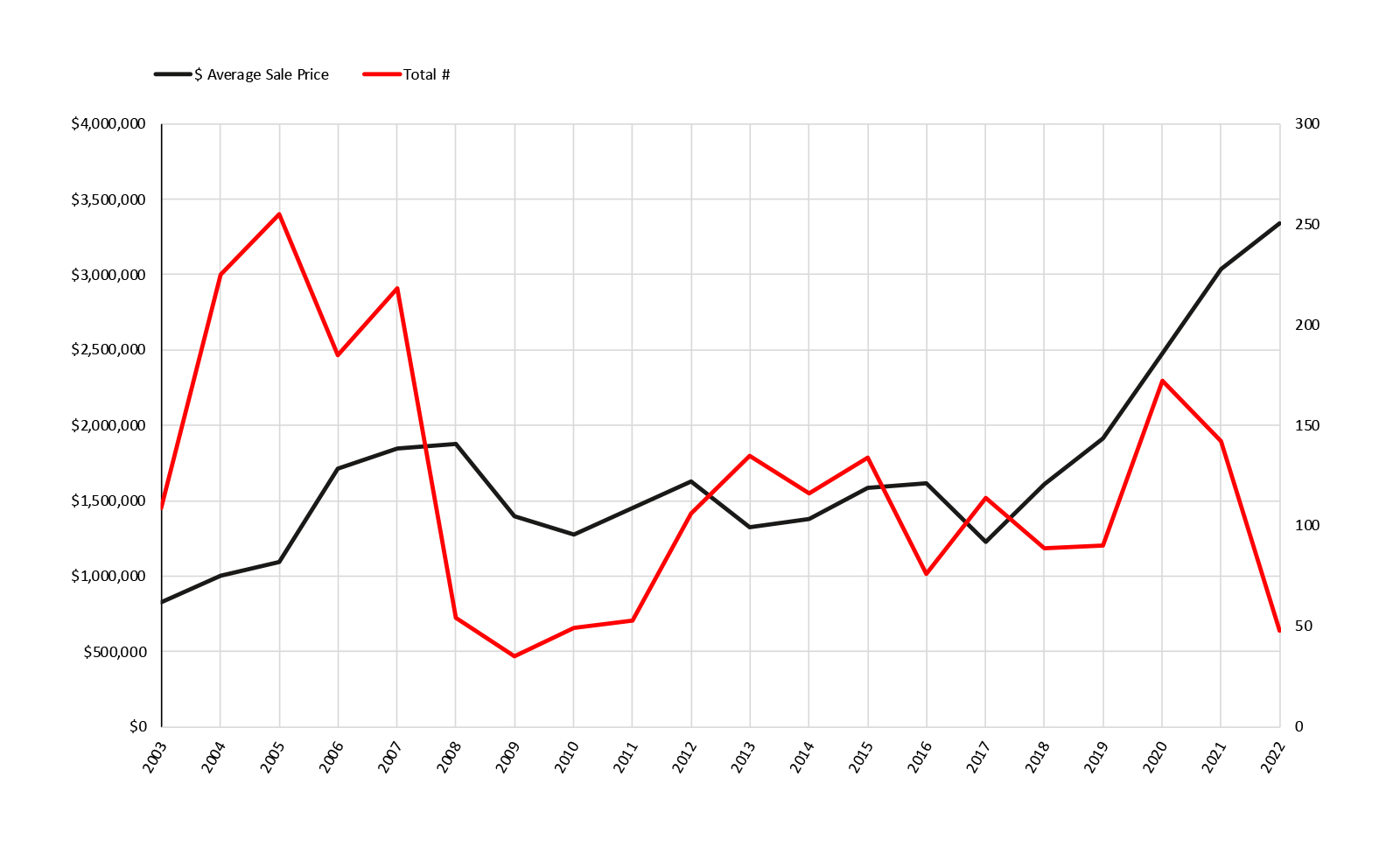

Dollar Volume Still Strong: Looking back, Q1 2022 ended with 57% fewer sales than Q1 2021 in the height of COVID. This dramatic drop in the number of sales continued throughout the year, ending with 49% fewer sales than year’s-end 2021. Normally, with this dramatic drop in the number of sales, one would think the dollar volume would follow. This was not the case in 2022 as the dollar volume was only down 24% to $2.25 billion— the third highest annual dollar volume in Jackson history.

So, what’s going on? The dramatic drop in the number of sales can be attributed to home mortgage interest rates doubling, inflation hitting a 40-year high, trillions of dollars wiped out in the stock market, and cryptocurrency taking a big hit. Locally, the lack of affordable homes and condo/townhomes under $1 million cut the number of Buyers by more than 50%. NOTE: At the beginning of 2022, no single-family home was listed for under $1 million. By the end of the year only two homes actually sold for under $1 million. These compounding factors have sidelined Buyers who are waiting to see what happens next.

The strong showing in dollar volume this year was not unexpected. Part of the increase came from the commercial side of the market with $696 million in dollar volume; most of which came from the sale of five hotels in the valley: Four Seasons in Teton Village, Amangani in Spring Creek Ranch, Red Lion Wyoming Inn, Homewood Suites, and Motel 6 in the Town of Jackson.

The record-breaking average sale price increases across the board also contributed to the strong dollar volume. The average condo/townhome sale price increased 81%, vacant residential land sale price increased 10%, and the single-family home sale price increased 6%.

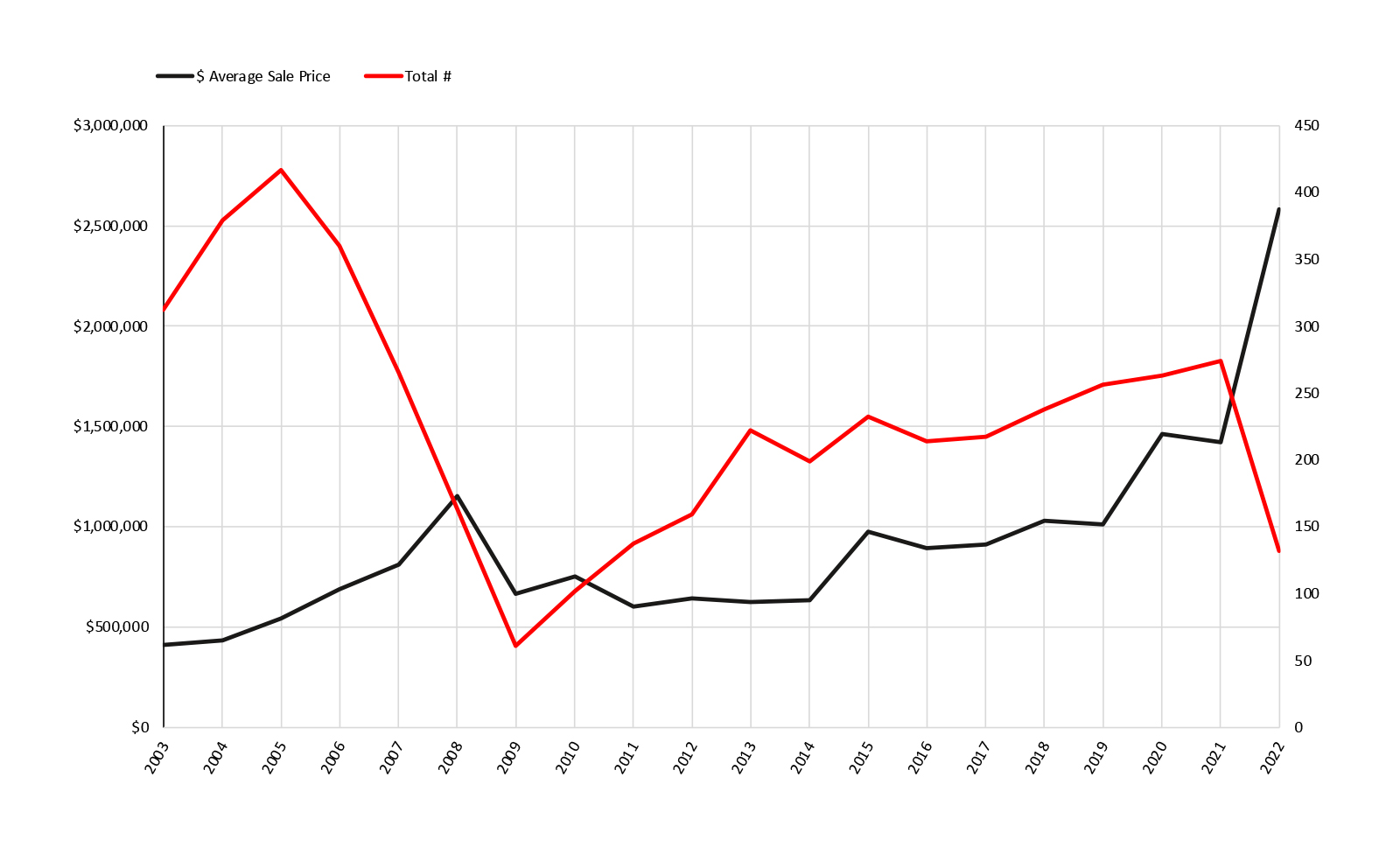

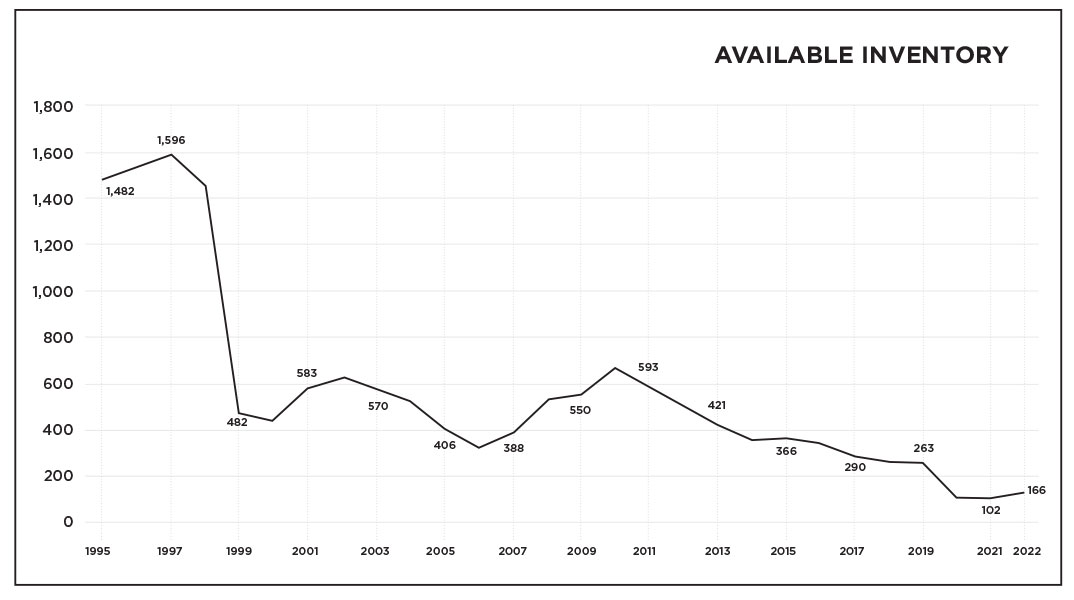

Inventory: Why are we not seeing more inventory hitting the market? Except for a few high-end spec homes and a handful of new luxury condos in the Town of Jackson, we continue to experience limited new inventory. Resale inventory continues to plummet, too, except for the few locals who have cashed in after retiring and/or moved over the hill or to Alpine. Take for example the three most popular residential neighborhoods in South Park: Melody Ranch, Rafter J, and Cottonwood Park. In 2022, these three neighborhoods had a total of 29 home sales versus 2019 with 44 home sales and 2013 with 73 home sales.

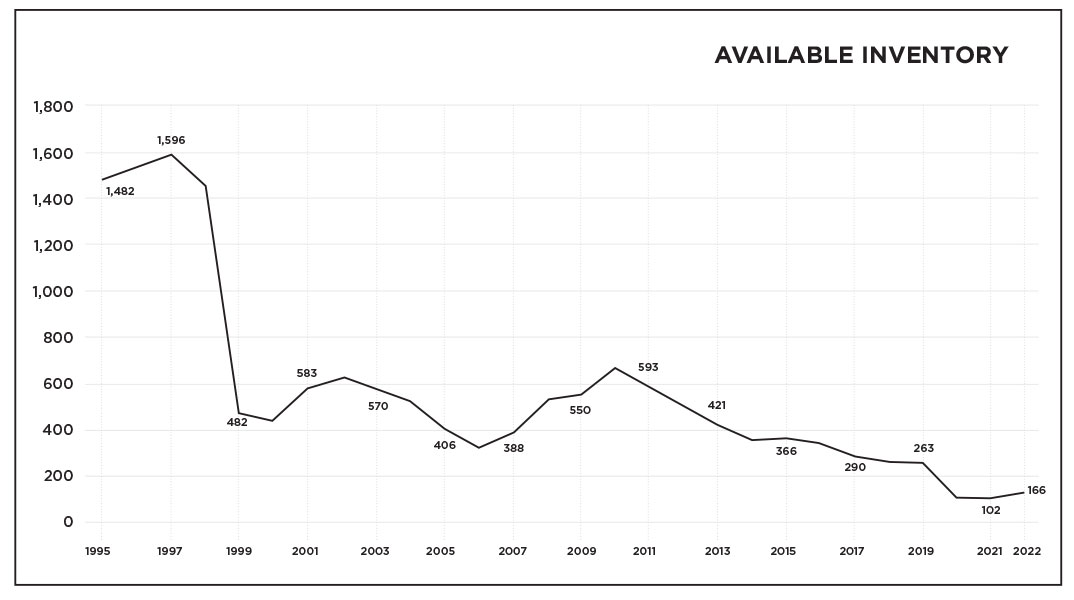

Inventory level 3rd lowest in 40 years: While the overall number of available listings increased 63% from this period in 2021, it’s still the third lowest we’ve seen in 40 years with 166 active. NOTE: The highest overall number of active listings in the history of Jackson Hole happened back in 1996 with 1,596 active listings at year’s end. Of those, 529 were single-family homes versus the mere 77 single-family homes currently on the market.

Five factors contribute to this lack of inventory; the largest being the lack of local property owners trading up. It is estimated that up to 35% of all transactions in the last 30 years have been trade-ups. Historically, a first-time home buyer in Jackson would purchase a small condo. After a few years, enough equity accrued to sell the condo and buy a small, single-family home with a backyard. After a few more years of built-up equity, the homeowners would trade up to a home with a few acres. Today, as prices have skyrocketed, it is almost impossible for a condo owner to trade up to the least expensive single-family home ($1.3 million)—putting the American dream of home ownership out of reach for many. NOTE: At the end of 2022 only 1.4% of all free-market deeds were listed for sale in Teton County. Nationwide, the average in a given county at any given time is 10% of the overall free-market deeds.

While no one knows exactly what the future has in store for Jackson Hole, we predict prices will flatten out in some segments and continue to climb in others. Those hoping competition will slow in 2023 are out of luck. We believe in 2023 Buyers can expect trends similar to the past two years: elevated prices, low inventory, and bidding wars on well-priced listings. Also, expect inventory levels to decrease continuously until Spring 2023.

When buying real estate in the next year, it will be important to watch new listings (including ‘coming soon’ listings) and be prepared to not only visit the property quickly, but to decide and extend an offer almost immediately. That said, don’t overpay. Prices will be up, but that doesn’t mean you have to pay something outside of the current market. Make sure you have a local Realtor to help navigate you through the bidding process and provide as many recent comps as possible. Be sure to also make your offer contingent upon an appraisal. If it does not appraise at the agreed to price, you can renegotiate or back out.